Are you a college student who wants to master the art of financial fitness? Well, you’ve come to the right place! In this article, we’ll dive into some essential money management tips specifically designed to help college students like you navigate the world of finances.

Money management is crucial, and it’s never too early to start developing good financial habits. So, whether you’re a freshman just starting your college journey or a senior preparing to graduate, these tips will empower you to take control of your money and set yourself up for a successful financial future.

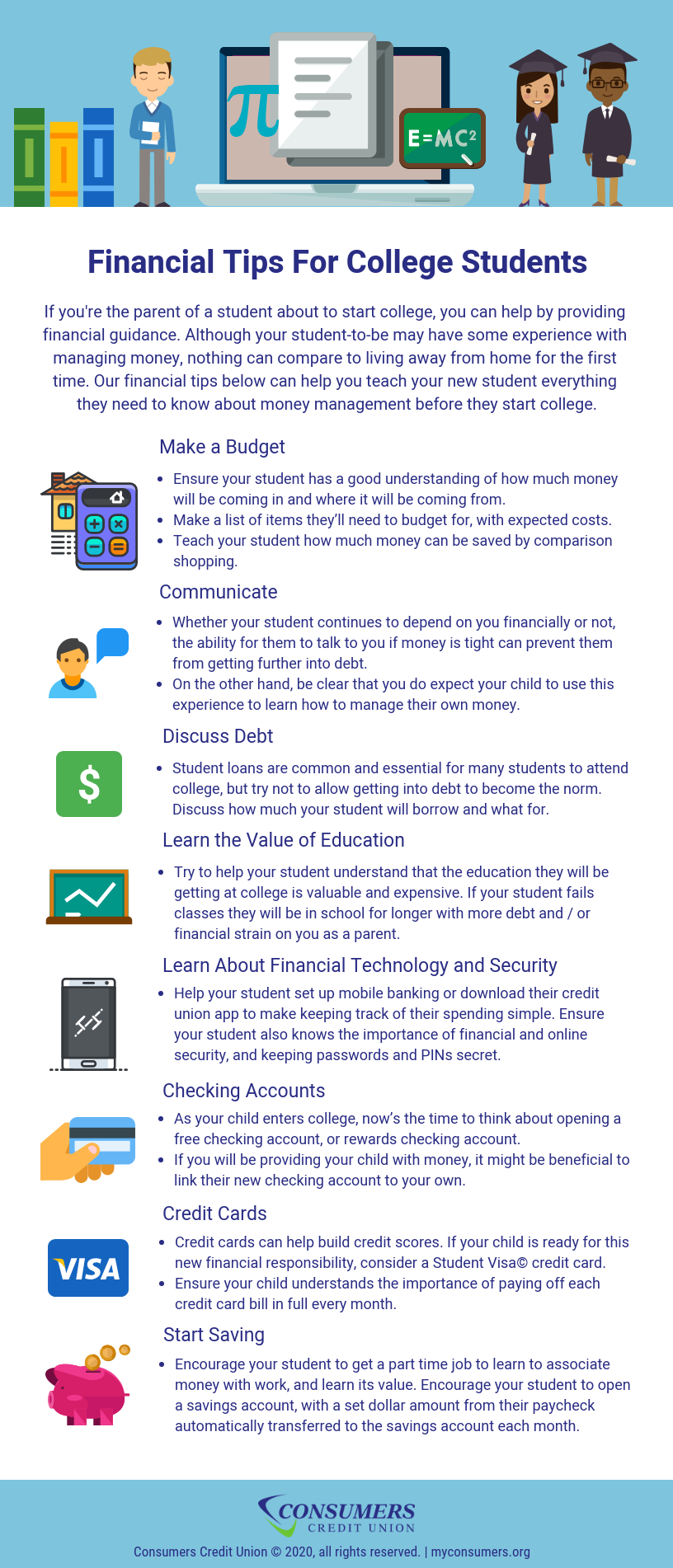

From budgeting and saving to spending wisely and avoiding debt traps, we’ve got you covered. So, let’s buckle up and embark on this exciting journey towards financial fitness! Are you ready to level up your money management skills? Let’s dive in!

1. Create a budget and track your expenses.

2. Take advantage of student discounts.

3. Minimize student loan debt by applying for scholarships and grants.

4. Find part-time employment or freelance gigs to supplement your income.

5. Save money by cooking at home and avoiding unnecessary expenses.

By following these strategies, you can achieve financial fitness and set yourself up for success after college.

Financial Fitness: Money Management Tips for College Students

As a college student, learning to manage your finances is an essential skill that will set you up for a successful future. Effective money management can help you avoid unnecessary debt, build savings, and develop good financial habits. In this article, we will provide you with valuable tips and advice on how to achieve financial fitness while navigating the world of college life.

Creating a Budget: Building a Solid Foundation

One of the first steps towards financial fitness is creating a budget. Start by tracking your income and expenses for a month to get a clear understanding of your spending habits. Identify any areas where you can cut back or make adjustments. Allocate funds for essentials like rent, groceries, and bills, and set aside a portion for savings or emergencies. Consider using budgeting apps or online tools to help streamline the process.

Once you have your budget in place, stick to it. Avoid impulse purchases and unnecessary expenses. Prioritize your spending and focus on your needs rather than wants. By following a budget, you’ll have a better overview of your finances and make informed decisions about where your money should go.

Benefits of Budgeting:

- Allows you to plan your spending and saving.

- Helps you avoid overspending and accumulating debt.

- Gives you a sense of control and peace of mind.

Now that you have a budget in place, let’s explore other key areas of financial fitness for college students.

Managing Student Loans: A Balancing Act

For many college students, student loans are a reality. While they can provide important financial support for your education, managing them effectively is crucial. Start by understanding the terms of your loans, including interest rates and repayment options. Consider making interest payments while in school to avoid unnecessary accumulation of debt.

If you’re struggling to make payments, consider exploring options like income-driven repayment plans or loan forgiveness programs. Take advantage of resources provided by your college or university to seek advice and guidance. It’s important to remember that student loan debt can have long-term implications, so staying informed and proactive is key.

Tips for Managing Student Loans:

- Research and understand your loan terms.

- Consider making interest payments while in school.

- Explore repayment options and seek guidance if needed.

By effectively managing your student loans, you can minimize financial stress and focus on building a stable financial future.

The Power of Saving: Building Emergency Funds

Saving money, no matter how small the amount, is a powerful financial habit that can provide a safety net for unexpected expenses. Start by setting achievable savings goals. Aim to save a portion of your income each month, even if it’s just a few dollars. This will develop the habit of saving and help you build an emergency fund over time.

Consider opening a separate savings account specifically for emergencies. This will help you resist the temptation to spend the money on non-essential items. Additionally, explore savings options that offer higher interest rates, such as certificates of deposit (CDs) or high-yield savings accounts. With disciplined saving, you’ll have peace of mind knowing that you’re prepared for unexpected financial challenges.

Tips for Building Emergency Funds:

- Set achievable savings goals.

- Create a separate savings account for emergencies.

- Explore savings options with higher interest rates.

Building an emergency fund will provide you with a cushion when unexpected expenses arise, ensuring you’re financially prepared for any situation.

Part-Time Work: Balancing Academics and Income

Many college students opt for part-time jobs to supplement their income and gain valuable work experience. When considering part-time work, it’s important to strike a balance between your academic commitments and your employment responsibilities.

Find a job that offers flexible hours, allowing you to dedicate sufficient time to your studies. Consider on-campus employment opportunities, as they often come with more accommodating schedules. Prioritize your academics and ensure that your work schedule doesn’t interfere with your ability to attend classes or complete assignments.

Tips for Balancing Part-Time Work and Academics:

- Look for jobs with flexible hours.

- Consider on-campus employment opportunities.

- Prioritize academics and maintain a healthy work-life balance.

By finding the right balance between work and academics, you can earn income while still excelling in your college studies.

Maximizing Student Discounts: Stretching Your Dollars

As a college student, you’re often eligible for various discounts and perks. Take advantage of these opportunities to stretch your dollars and save money. From discounted movie tickets to special rates on transportation, always carry your student ID and inquire about available discounts wherever you go.

Additionally, explore student discount programs and apps that can help you find deals and exclusive offers tailored to college students. By being proactive and aware of the discounts available to you, you can make your money go further and save on expenses.

Tips for Maximizing Student Discounts:

- Always carry your student ID.

- Inquire about student discounts wherever you go.

- Download student discount apps or join discount programs.

By utilizing student discounts, you can save money on everyday expenses and make the most of your college experience.

Using Credit Cards Wisely: Building Credit and Avoiding Debt

Credit cards can be a helpful tool when used responsibly. They allow you to build credit history, which is important for future financial goals such as renting an apartment or applying for a loan. However, it’s crucial to use credit cards wisely and avoid falling into debt.

Start by choosing a credit card with favorable terms, such as a low interest rate and no annual fees. Use your credit card sparingly and make payments in full and on time each month to avoid accumulating interest charges. Limit your credit card usage to essential expenses and be cautious about overspending.

Tips for Using Credit Cards Wisely:

- Choose a credit card with favorable terms.

- Use credit cards sparingly and pay in full each month.

- Avoid overspending and prioritize essential expenses.

By using credit cards responsibly, you can build good credit habits and avoid unnecessary debt.

Planning for the Future: Investing in Yourself

While managing money in the present is crucial, it’s also important to plan for your future. Investing in yourself through education, internships, and skill-building opportunities can have long-term financial benefits.

Consider pursuing scholarships or grants to help reduce the financial burden of your education. Seek out internships or part-time jobs in your field of interest to gain practical experience and enhance your resume. Additionally, invest in personal development by learning new skills or taking professional courses that align with your career goals. These investments in your future can lead to better job prospects and higher earning potential.

Tips for Investing in Yourself:

- Apply for scholarships or grants to reduce educational costs.

- Seek out internships or part-time jobs in your field of interest.

- Invest in personal development through skill-building opportunities.

By investing in yourself, you’ll be better equipped to achieve financial success and reach your long-term goals.

Additional Financial Fitness Tips for College Students

Now that we’ve explored the key areas of financial fitness, here are a few additional tips to help you on your journey:

1. Set Realistic Financial Goals

By setting specific and achievable financial goals, you’ll have a roadmap to guide your money management decisions.

2. Seek Financial Guidance and Resources

Take advantage of the financial resources available to you, such as financial advisors, workshops, and online resources.

3. Avoid Impulse Purchases

Think twice before making spontaneous purchases. Consider if it aligns with your budget and long-term financial goals.

4. Prioritize Credit Score Management

Maintain a good credit score by paying bills on time and keeping your credit utilization low. This will benefit you in the future when applying for loans or credit cards.

5. Establish Healthy Financial Habits

Develop routines that promote good financial habits, such as reviewing your budget regularly and saving consistently.

6. Share Expenses with Roommates

If you have roommates, consider sharing expenses like groceries, utility bills, and rent to reduce individual costs.

7. Stay Mindful of Student Discounts

Continuously seek out student discounts and take advantage of them whenever possible to stretch your budget.

8. Avoid Overborrowing

When taking out loans or using credit cards, borrow only what you need and can afford to repay comfortably.

9. Practice Self-Control

Avoid unnecessary splurges and impulse spending. Learn to differentiate between wants and needs, and make intentional choices.

10. Regularly Review Your Financial Situation

Take the time to assess your financial health regularly. Adjust your budget, savings goals, and strategies as needed.

In Summary

Financial fitness is a lifelong journey, and as a college student, it’s important to start developing good money management habits early on. By creating a budget, managing student loans, prioritizing savings, finding a balance between work and academics, maximizing student discounts, using credit cards responsibly, and investing in yourself, you’ll be well on your way to achieving financial fitness. Remember to set realistic goals, seek guidance, and develop healthy financial habits along the way. With consistent effort and smart decision-making, you’ll be prepared for a financially secure future.

Key Takeaways: Financial Fitness – Money Management Tips for College Students

- 1. Create a budget and track your expenses.

- 2. Avoid impulse buying and prioritize your needs over wants.

- 3. Take advantage of student discounts and free resources.

- 4. Get a part-time job or explore ways to earn extra income.

- 5. Start saving early and establish an emergency fund.

Frequently Asked Questions

Are you a college student eager to improve your financial fitness? Managing money while in college can be challenging, but it’s a crucial skill to develop. To help you on your journey, we’ve put together some frequently asked questions about money management tips specifically tailored for college students.

Q1: How can I create a budget that works for me?

Creating a budget is an essential step in managing your finances effectively. Start by tracking your income and expenses, including tuition, housing, food, transportation, and entertainment. Calculate your monthly expenses and compare them to your income. Identify areas where you can cut back and save, and set realistic spending limits for each category. Finally, stick to your budget by tracking your expenses regularly and making adjustments when needed.

Remember, budgeting is all about balance. It’s okay to have some room for fun and entertainment, but be mindful of your overall financial goals. With a well-planned budget, you’ll be able to make smarter financial decisions and avoid unnecessary debt.

Q2: What can I do to save money as a college student?

As a college student, saving money is key to maintaining financial stability. Start by looking for ways to cut expenses. Consider buying used textbooks or renting them instead of buying new ones. Take advantage of student discounts and deals whenever possible. Cook your meals at home instead of eating out frequently. Opt for public transportation or carpooling instead of owning a car, if feasible.

Additionally, explore part-time job opportunities on campus or nearby. Keep an eye out for scholarships and grants that you may be eligible for. Prioritize your needs over wants and practice delayed gratification. By adopting these saving strategies, you’ll be able to build a strong financial foundation for your future.

Q3: How can I manage student loans effectively?

Student loans can be a significant financial burden, but there are ways to manage them effectively. Begin by understanding the terms of your loans and carefully read the repayment options. Create a plan that suits your financial situation, such as an income-driven repayment plan that adjusts based on your income level. Explore student loan forgiveness programs or scholarship opportunities that can help reduce your debt.

Make timely payments to avoid late fees and consider making extra payments whenever possible to reduce interest over time. Remember, communication is key. If you’re facing financial difficulties, contact your loan servicer to discuss options like loan deferment or forbearance. By staying proactive and informed, you’ll be able to navigate your student loans more effectively.

Q4: What strategies can I use to build credit as a college student?

Building credit is an important aspect of financial fitness, even as a college student. Start by opening a secured credit card or becoming an authorized user on a family member’s credit card to establish credit history. Make small purchases and pay off your balances in full each month to demonstrate responsible credit behavior.

Consider taking out a small personal loan or credit builder loan from a reputable financial institution. Make timely payments to build a positive credit history. It’s also crucial to keep an eye on your credit report for any errors or fraudulent activity. Building good credit now will benefit you in the long run when you need to make larger purchases, such as a car or a home.

Q5: How can I balance my financial responsibilities and still enjoy college life?

Managing your financial responsibilities while enjoying college life is all about finding a balance. Start by prioritizing your needs and creating a budget that allows for some fun and entertainment. Look for affordable or free activities on campus or in your community.

Consider joining student clubs or organizations that offer social activities and events without breaking the bank. Use your student ID for discounts at local businesses. By finding creative ways to have fun on a budget, you can still enjoy your college experience while staying financially responsible.

Money Management Tips for College Students

Summary

Now that we’ve learned about money management tips for college students, let’s do a quick recap!

First, we talked about setting a budget. This means deciding how much money you have and how much you can spend on things like food, books, and fun. It’s important to keep track of your expenses so you don’t overspend.

Next, we learned about the importance of saving money. By putting some money aside each month, you can be prepared for unexpected expenses or save up for something you really want. Remember, even small amounts can add up over time!

Lastly, we discussed the value of being mindful of your spending habits. It’s easy to get caught up in impulse buying, but it’s important to ask yourself if you really need something before you buy it. Being mindful can help you make smarter financial decisions.

By setting a budget, saving money, and being mindful of your spending, you can become financially fit and make your college years a little less stressful when it comes to managing your money. Remember, it’s never too early to start practicing good money habits. So go out there and make wise choices with your hard-earned cash!